Call Center Training Course

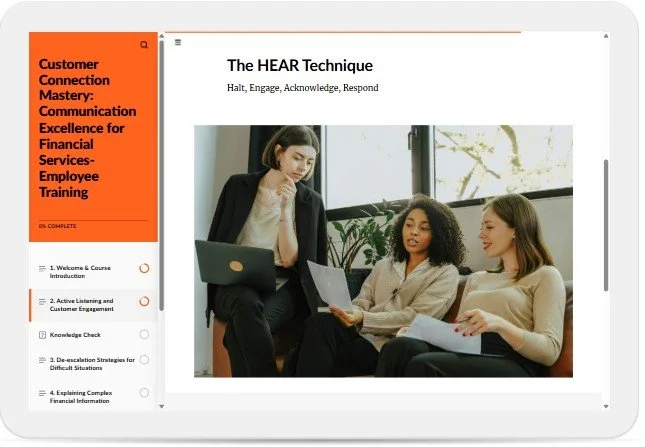

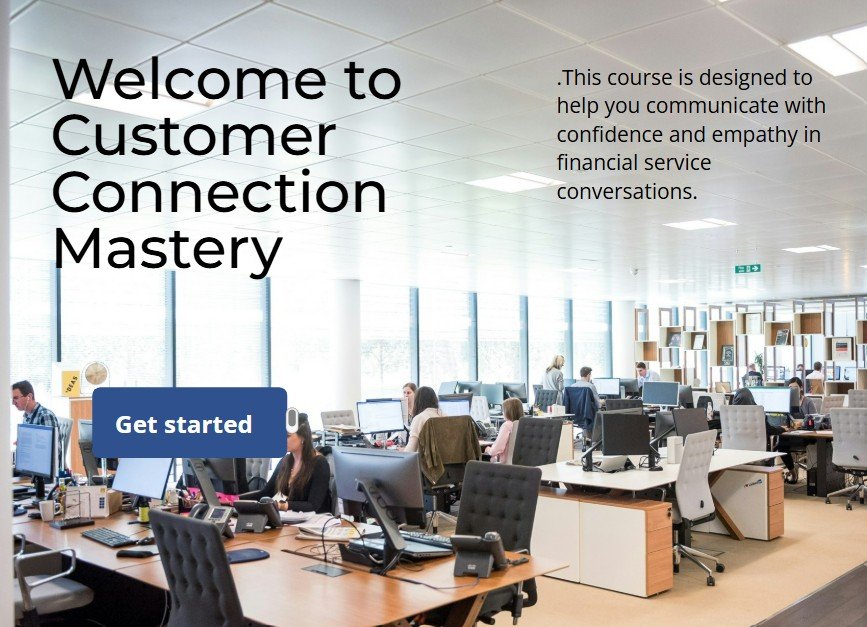

Customer Connection Mastery: Communication Excellence for Financial Services

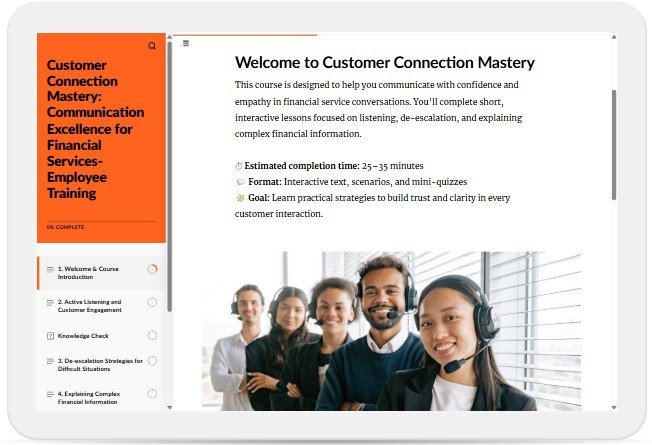

Authoring Design Tool: Articulate Rise

View full eLearning course here

Course Layout

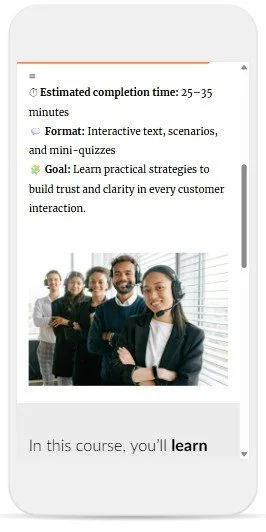

Total Estimated Duration: 25–35 minutes

Structure Type: Modular → Each topic = 1 lesson (4 total lessons)

Interactivity: Mix of text, multimedia, scenario blocks, and knowledge checks

Goals

The primary goal of this training is to strengthen employees’ ability to communicate effectively across customer touchpoints—from live calls to secure messaging channels—while ensuring regulatory compliance.

The course aims to:

Equip employees with foundational communication principles (clarity, empathy, professionalism).

Improve their ability to de-escalate complaints and handle sensitive financial conversations.

Strengthen trust-building skills with customers by modeling transparent and compliant communication.

Reduce communication-related errors that impact customer satisfaction and audit outcomes.

Support consistent communication standards across teams and departments.

Ultimately, the training empowers employees to represent the financial institution with professionalism and confidence, leading to higher customer satisfaction, stronger client relationships, and fewer compliance risks.

Overview

The employee corporate training solution is designed to elevate frontline employees’ communication skills in a highly regulated, customer-centric industry. The course blends scenario-based learning, microlearning, and interactive practice to help employees communicate with clarity, empathy, and accuracy while maintaining compliance standards.

The training addresses challenges common within financial service environments—complex customer inquiries, regulatory constraints, high-pressure interactions, and the growing need for digital communication fluency. By combining behavioral science, adult-learning principles, and real-world communication scenarios, the solution helps employees build confidence, reduce errors, and deliver exceptional service experiences.

My Process

As the Instructional Designer, I led the end-to-end design using a structured, research-informed process aligned with ADDIE and backed by evidence-based learning strategies.

Discovery & Analysis

I partnered with key stakeholders—including Customer Service leadership, Compliance SMEs, and Communication Training partners—to understand performance gaps, communication pain points, and regulatory constraints.

Key findings included:

Variability in communication tone and clarity.

High volume of escalations linked to miscommunication.

Employees lacking structured frameworks for professional, empathetic interactions.

I synthesized insights into learner personas and actionable project goals to ensure the training directly addressed real operational needs.

2. Learning Experience Strategy

I designed the experience as a blended, scenario-rich microlearning solution. The strategy emphasized:

Authentic scenarios reflecting real customer interactions.

Practice-first moments, enabling learners to apply skills in realistic, low-risk situations.

Modular content to support flexible consumption for busy frontline teams.

Mayer’s multimedia principles to reduce cognitive load and support deep learning.

I developed detailed storyboards outlining:

Learning objectives aligned to communication competencies.

A structured flow using conversational modeling, step-by-step frameworks, and branching scenarios.

Knowledge checks and formative feedback to reinforce skill acquisition.

The instructional design leveraged:

Simulation-based dialogue practice.

Visual exemplars of strong vs. weak communication.

Audio-supported narratives to model tone and phrasing.

Using Rise 360, I created a modern, intuitive learning experience with:

Interactive blocks for concept exploration.

Video and audio modeling communication best practices.

Branching scenarios and decision-based responses.

Compliance-approved language templates and scripts.

The design ensured accessibility, mobile responsiveness, and minimal cognitive load—optimized for busy financial service teams.

3. Content Design & Storyboarding

4. Development & Prototyping

5. Evaluation & Iteration

Before release, I conducted stakeholder walkthroughs, SME reviews, and user testing with a pilot group. Insights gathered led to refinements in:

Scenario complexity

Clarity of examples

Feedback messaging

This iterative refinement ensured the solution was practical, relevant, and user-centered.

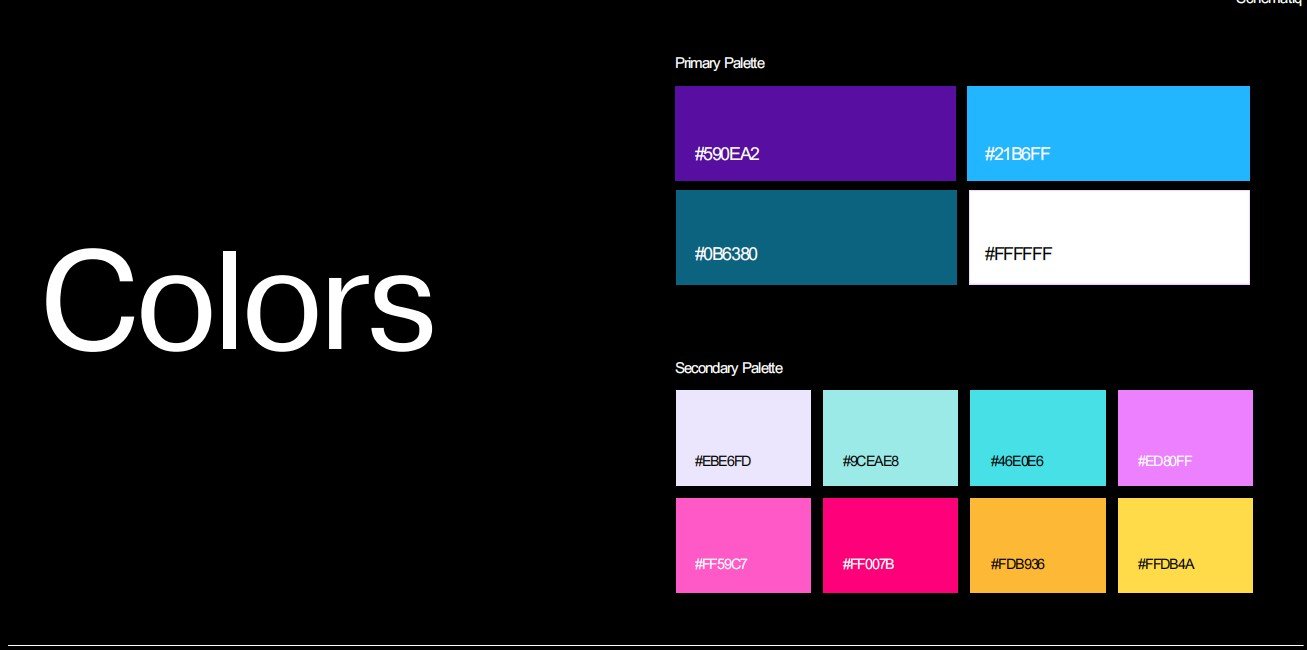

Artifacts

Rise 360 view full course

Storyline 360 view full course

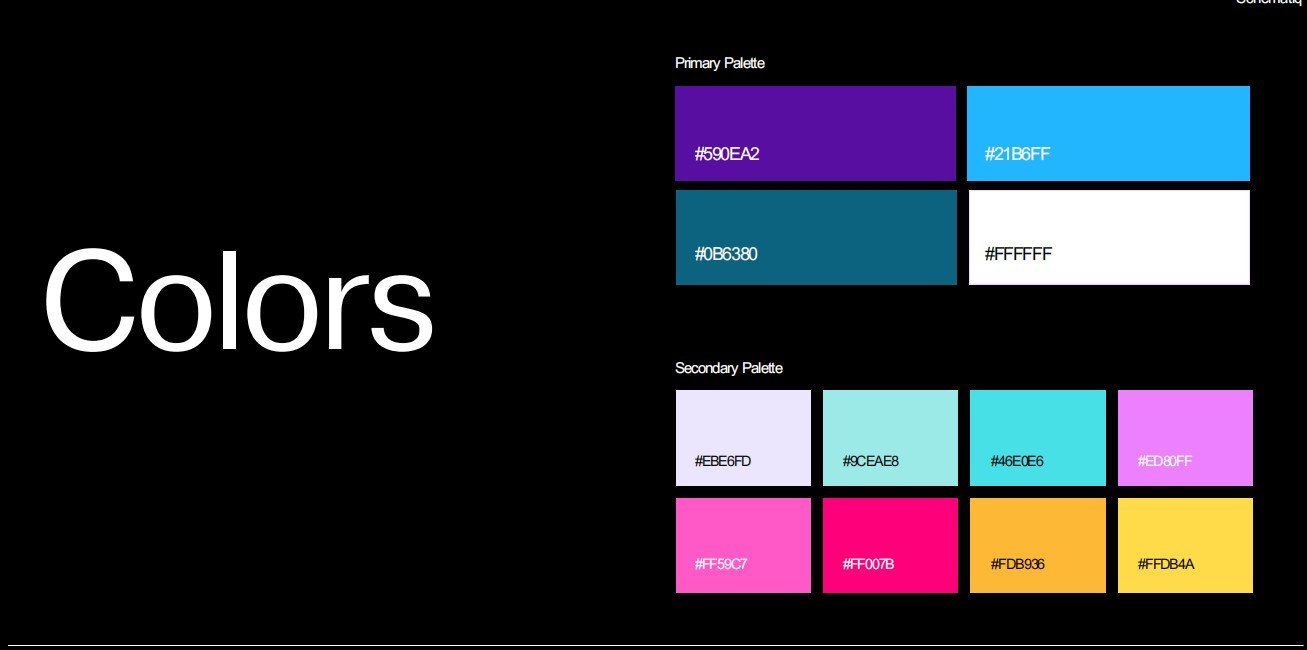

eLearning Style Guide view

eLearning Storyboard view